Millennials face Big Interest. Boomers face Big Equity!

Recently I’ve been talking to clients representing two different generations—millennials and boomers. It’s been fascinating how they are both facing questions involving money, taxes, and financing, with very different needs, pressures, and perspectives.

Consider the millennials and their experience of tax deductions and interest rates: after the 2017 tax changes, most Americans stopped itemizing. Now consider this: a buyer who puts 20% down on a $1M home borrows $800,000. At 6.5% interest, they’re paying about $53,700 in mortgage interest the first year. Not all of that is deductible. About $48,750 woudl be. That’s well above the $29,200 standard deduction for married couples. So is that a big tax break for the person who bought the house?

Well, ask that person if they feel like they’re getting a tax break when their monthly payment is around $6000. It raises curious questions of when people feel privileged and when people feel squeezed, and who exactly is the “standard” person making the standard deduction?

In my experience with my clients, the tax code might look generous on paper, but in practice it’s cold comfort. Especially when buyers are stretching every month to make the math work.

Building wealth through real estate is not easy, but it's absolutely essential.

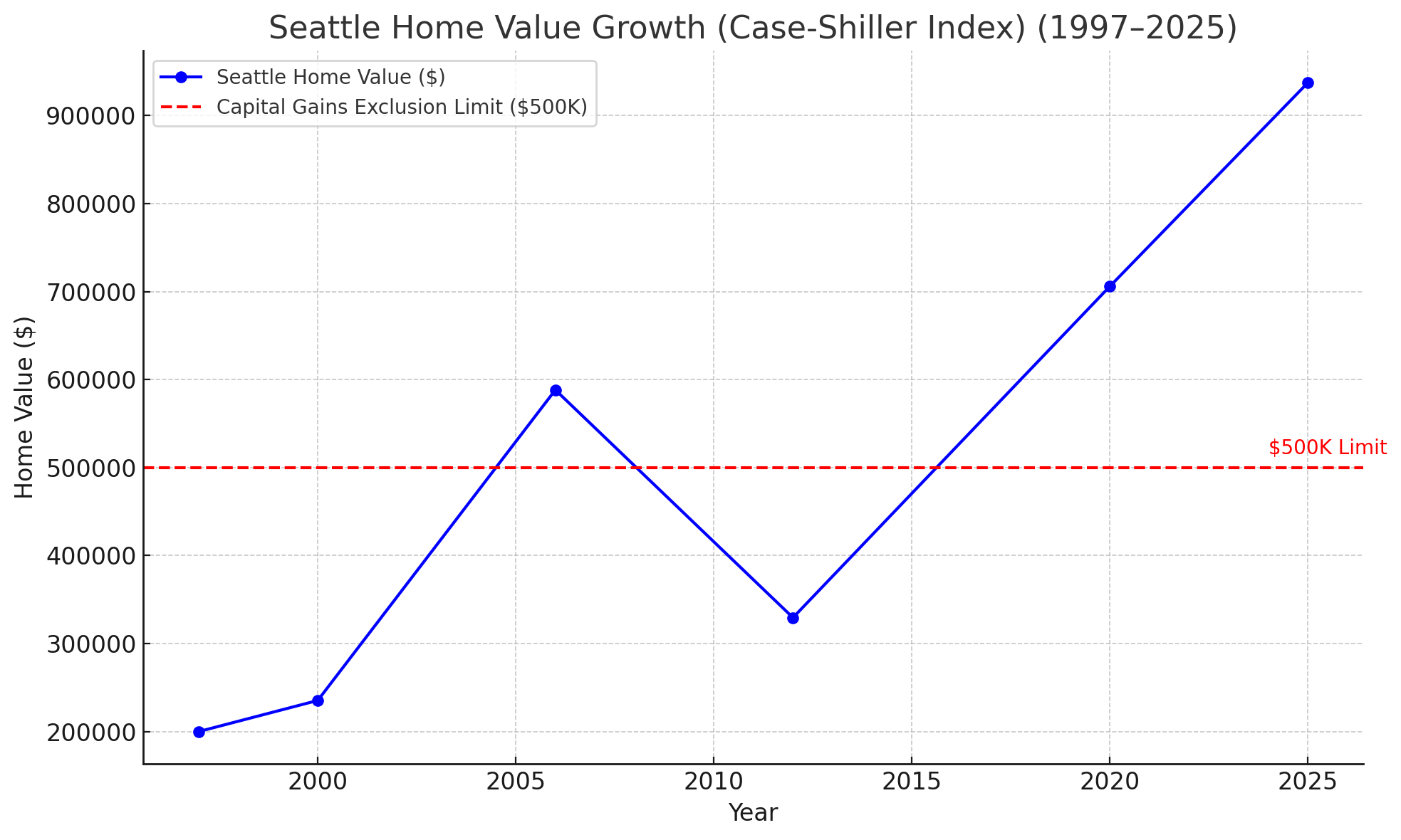

Consider the baby boomers, who are facing the very different problem of maintaining their real estate wealth. A married couple selling their longtime home can exclude up to $500,000 in capital gains taxes. Sounds generous—until you realize many baby boomers are sitting on $1M+ in appreciation.

I'm thinking that $500,000 deduction is too low.

It might have worked when homes cost $250,000. But in places like Seattle, it’s falling short. I meet homeowners—often aging baby boomers—sitting on $1M+ in equity. They bought decades ago, the value has appreciated dramatically.

If their gain exceeds $500,000, they’re writing a big check to the IRS. That’s a psychological barrier to making a move.

So they hold onto the house, even as they're asking themselves, "should I think about moving?" That keeps inventory tight.

Where Does That Leave Us?

Real estate is still one of the most powerful ways to build wealth. But let’s not pretend it’s easy. The challenges are real.

Compared to other economic powerhouse cities, Seattle is still relatively affordable. I’m reminded of this every time I talk to colleagues in New York or the Bay Area—there’s still room to get in here.

At the same time, baby boomers can and should hold on to their homes as long as it makes sense—economically and personally. But at some point, health and lifestyle may become more important than maximizing equity. When that time comes, I want people to feel empowered to make a move that’s right for them.

Want to talk through your options?

Let’s connect

- Matthew